boulder co sales tax efile

The Colorado state sales tax rate is currently. How to Apply for a Sales and Use Tax License.

Sales Use Tax.

. The current total local sales tax rate in Boulder County CO is 4985. The December 2020 total local sales tax rate was 8845. The minimum combined 2022 sales tax rate for Boulder County Colorado is.

Historic Preservation Tax 2009 - Ordinance No. Jail improvements and operation. Boulder County CO Sales Tax Rate.

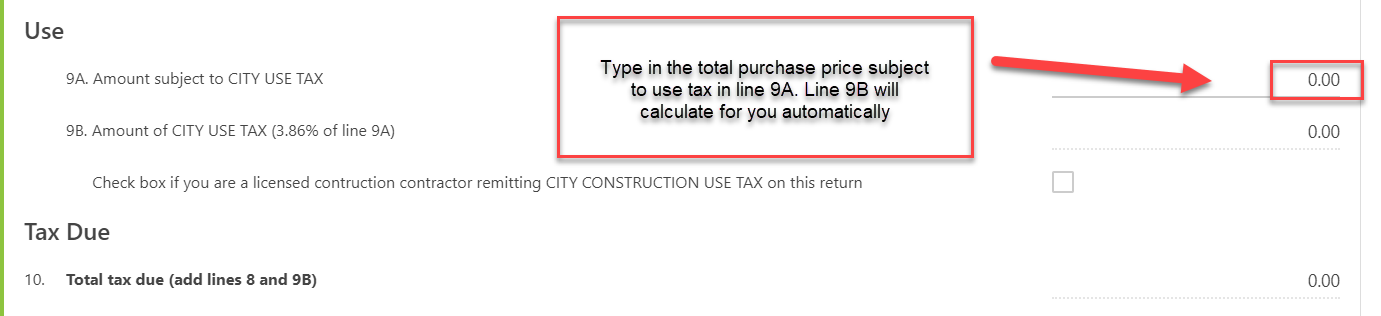

Sales and Use Tax. 428 Year and Month. This is the total of state county and city sales tax rates.

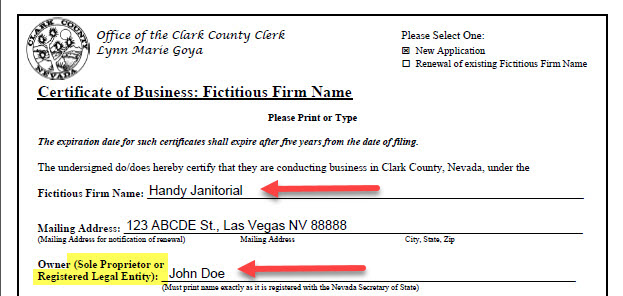

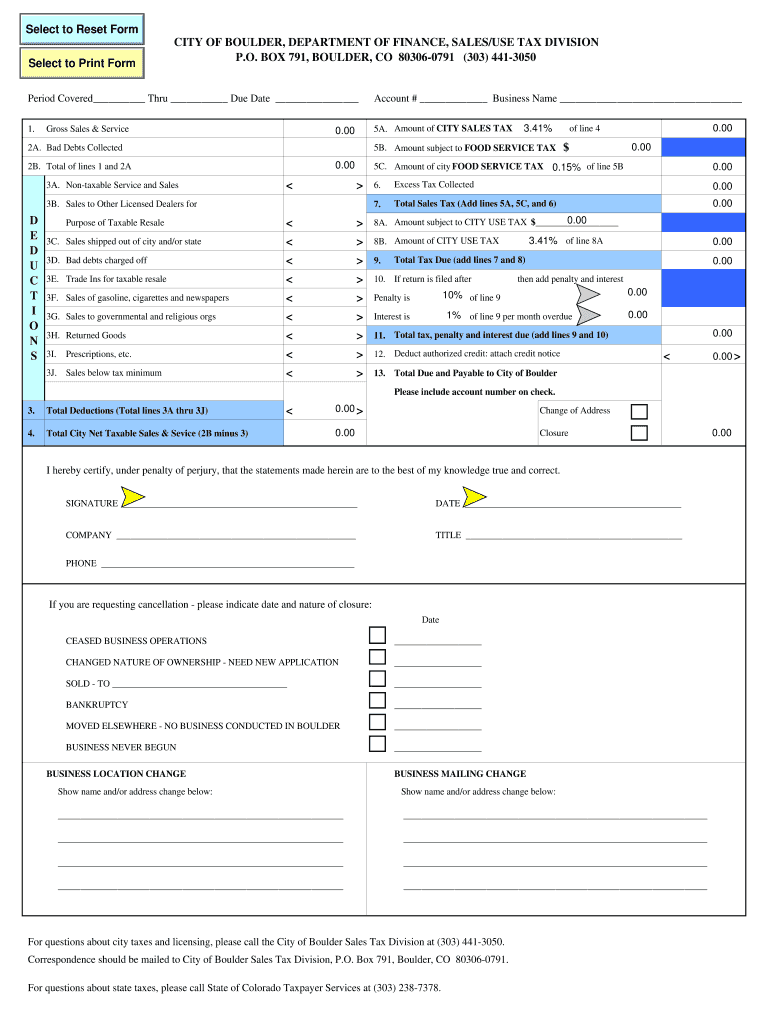

This tax must be collected in addition to any applicable city and state taxes. Tips on how to fill out the City of boulder sales tax returns on the web. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online.

The current total local sales tax rate in Boulder County CO is 4985. The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to. Construction Use Tax is the salesuse tax paid by contractors or homeowners for construction materials used when erecting building remodeling or repairing real property.

CO Sales Tax Rate. The minimum combined 2022 sales tax rate for Boulder Colorado is. Monthly returns are due the 20th day of month following reporting period.

With proof of payment sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a particular. The COVID-19 pandemic resulted in significant. The current total local sales tax rate in Boulder CO is 4985.

There are a few ways to e-file sales tax returns. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. 300 or more per month.

720 Title print only. Sales and Use Tax 2002 - Ordinance No. The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans.

Boulder CO Sales Tax Rate. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. The Colorado sales tax rate is currently.

Boulder County Sales Taxes. Sales tax returns must be filed monthly. Complete a Business License.

E-File Your Tax Return Online - Here. To start the blank utilize the Fill camp. County road and transit improvements.

The city use tax rate is the same as the sales tax rate. This is the total of state and county sales tax rates. There is no provision for any po rtion to be retained as a vendor fee.

Between 2009 and 2019 sales tax revenues in the city had steadily increased with the exception of a flattening between 2016 and 2017. You can print a 8845. Boulder Countys tax rate is 0985.

Non-profit human service agencies. Sign Online button or tick the preview image of the document. 10 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax.

Landowners Suing Boulder County Over Proposed Composting Facility At Site Of Former Nursery The Longmont Leader

Have You Filed Yet Federal Income Tax Deadline Is April 18

Rates Lafayette Co Official Website

How Do State And Local Soda Taxes Work Tax Policy Center

Sales Tax Services By Colorado Accounting Experts

Boulder County Government Facebook

Get Ready For Some Big Changes When Filing 2018 Taxes

Prepare And Efile Your 2021 2022 Colorado State Tax Return

Form Dr 0800 Fillable Location Jurisdiction Codes For Sales Tax Filing

How Colorado Accountants Ensured A New Tax Refund Law Will Benefit Everyone Denver Business Journal

Co Sales Tax Return City Of Boulder Fill Out Tax Template Online Us Legal Forms

File Online With Sales Tax Web File

Flood Response Cdbg Dr City Of Longmont Colorado

Dead And Company Concert Poster Folsom Field Boulder Co Dave Hu

Boulder Sbdc City Of Louisville Co

Sales Tax Boulder Form Fill Out And Sign Printable Pdf Template Signnow

At Home Colorado Boulder County Edition By Prairie Mountain Media Issuu